Blocksquare: the future of property tokenisation?

Last updated: 05 Sep 2022

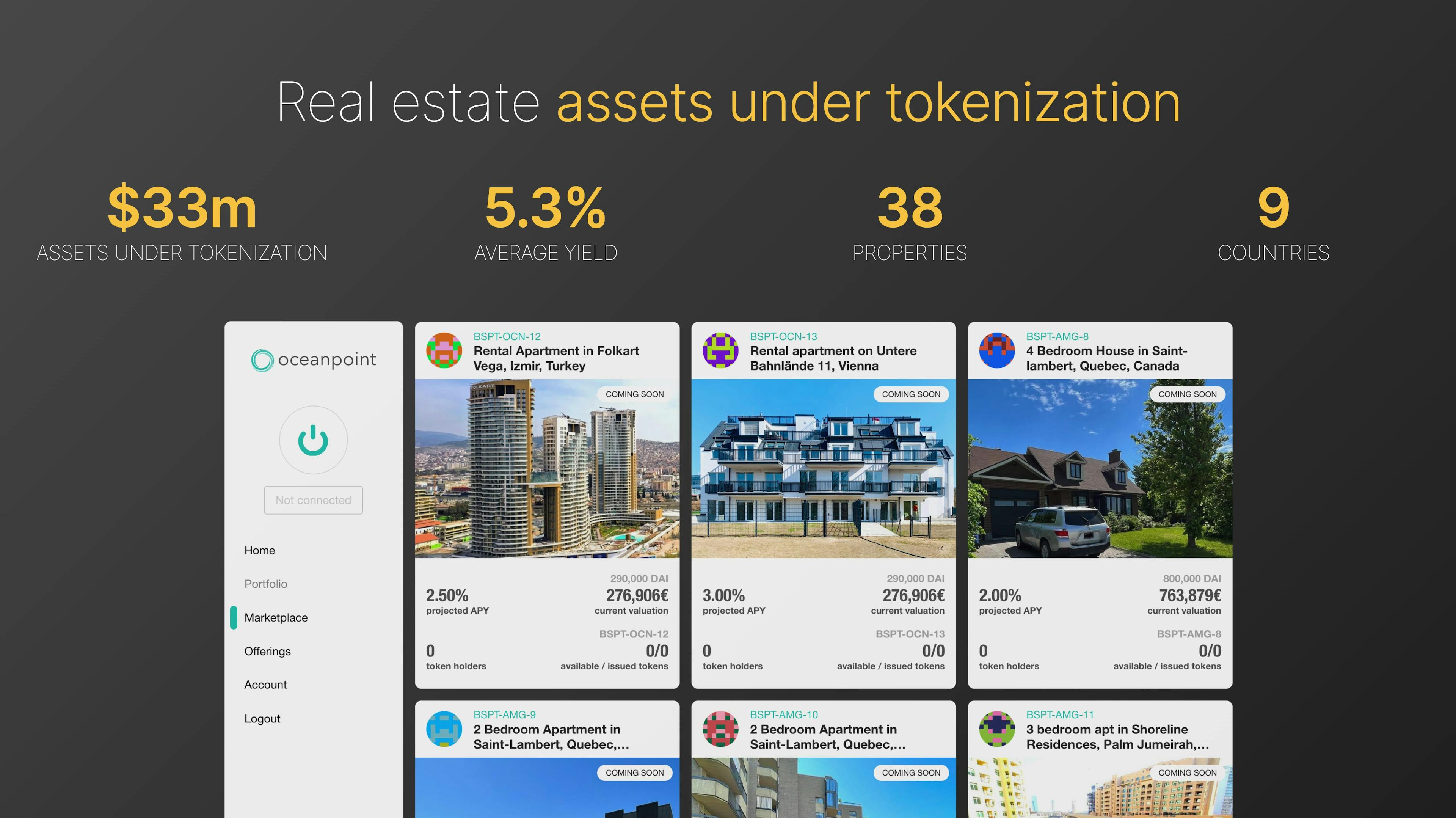

With over $40m and 45 properties tokenised on the the Blocksquare protocol, there is clearly some traction behind this well established crypto real estate project.

This could have something to do that the team behind have spent the past five years building their product, iterating on their initial concepts in true startup fashion until they came up with a tokenisation approach that is scalable and will work in the majority of jurisdictions around the world.

This is no mean feat. Real estate markets in most countries are heavily regulated and there are massive differences as you move between markets. What might work in the UK probably won't work in Australia and most definitely won't work in Dubai.

For a real estate tokenisation protocol to be succesful it has to break down the barriers that exist between markets and come up with an approach that will allow property owners to release liquidity from their investments and provide some guarantee to token holders that they will see their share of any property.

Token holders own a part of the economic rights

Blocksquare's approach to this is to not tokenise the ownership of a property, but to tokenise the economic rights of said property.

This means that owners of a token are entitled to a share of revenues generated from the tokenised property as well as a portion of any sale via a token buy back program.

When a property owner decides to tokenise their property, they split the economic rights between 100,000 property tokens and enter into a public corporation resolution which is a legally binding contract guaranteeing the revenues be distributed to token holders.

This contract is stored on IPFS and the hash of the resolution recorded into the resulting smart contract that manages the 100,000 property tokens.

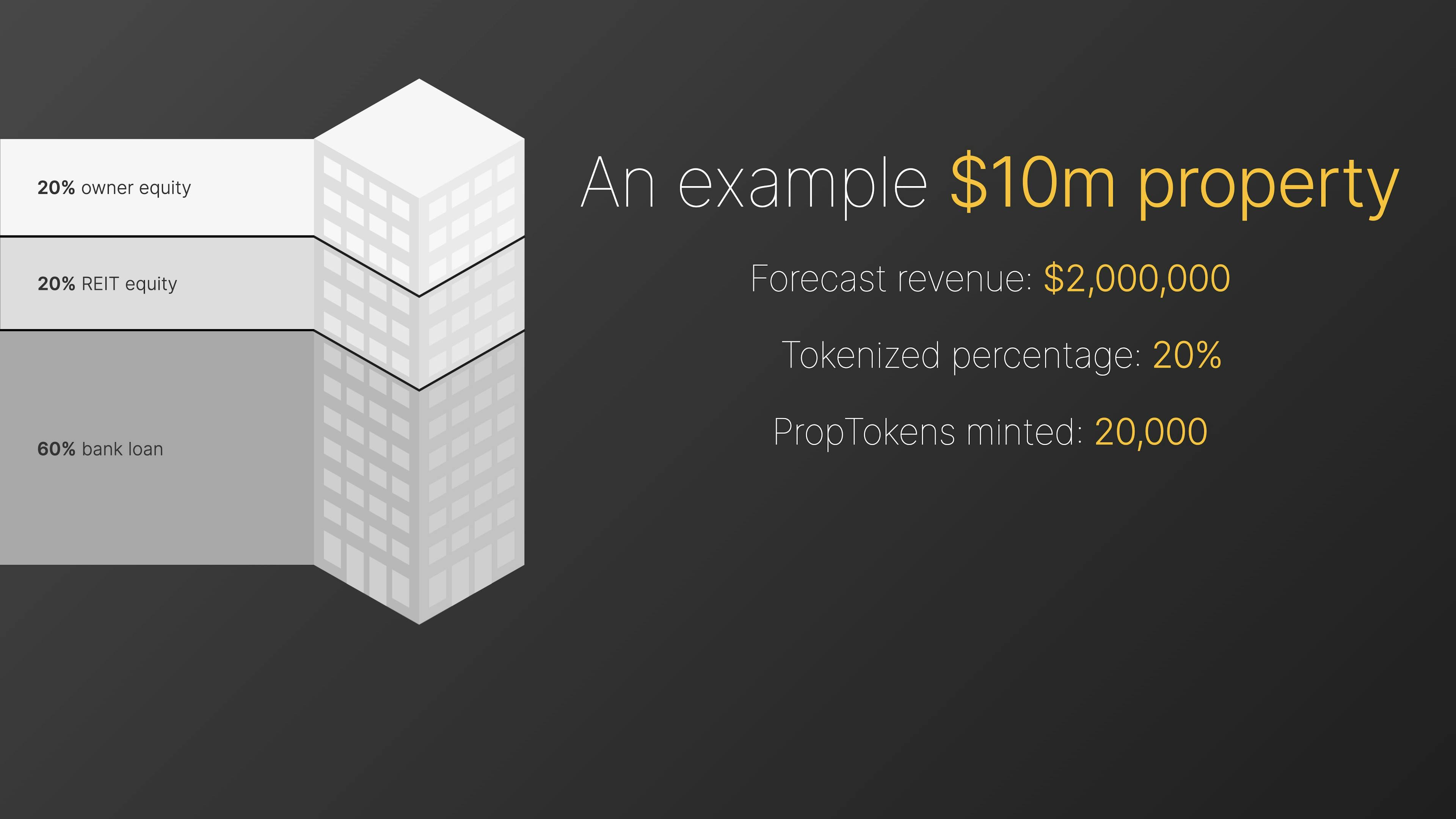

A worked example

Let's use a property valued at $10m as an example with:

- a 20% owner equity stake

- a 20% equity stake owned by a real estate investment trust

- a bank loan financing the remaining 60%.

If fully occupied, the property is forecast to bring in $2m in revenue. The owners have projected that they will need 40% of this revenue for direct and indirect costs.

In order to decrease their exposure and release funds for other investments, the owners and investment trust have decided to tokenise 20% of the property.

Under the Blocksquare protocol, the entire property is split into 100,000 tokens so, to tokenise 20% of the property, 20,000 tokens are minted from the PropToken contract

Revenues from the property will then be distributed to PropTokens following the formula:

Replacing that with the projected revenue of $2m, the revenue share of 60% and the 20% tokenization value, we get an annual revenue of $240,000 that will be distributed to PropToken holders.

What does a property owner do with their tokens?

They have a number of options. The most obvious, of course, is to sell tokens to interested parties. This can be done via the Blocksquare powered marketplace where any property owner can offer a defined number of tokens for sale.

The other option is to stake and ultimately sell property tokens to Oceanpoint, Blocksquare's DAO that is looking to connect the seemingly opposite worlds of DeFi and the real estate industry.

Oceanpoint

Blocksquare are building out Oceanpoint to become the world's first truly decentralized real estate fund. One that has been designed from the ground up to hold an unlimited amount of real estate assets and be open to anyone to invest in, no matter how much they have to invest or where in the world they are.

This is when real estate truly meets DeFi.

Except it's unlike any other real estate fund out there. This is partly down to the fact that it doesn't own equity in any property, instead it owns tokenised economic rights that property owners commit to pay the revenues for to the DAO, it also doesn't have any shareholders, instead it is governed by the community, and it also doesn't pool funds, it has POINT - it's own stablecoin collaterised by the real estate owned by the DAO.

In this way, Oceanpoint acts more like a real estate backed central bank than fund. Oceanpoint mints POINT when a PropToken is bought by the DAO, and burns it when a PropToken is sold. In this way, POINT and the TVL of Oceanpoint are intrinsicaly tied and ensures that POINT is collaterised appropriately.

So how does BST fit into this?

There are three main uses for BST.

First and foremost, BST acts as the Governance token for Oceanpoint. In order to be involved in DAO votes and help shape the future of Oceanpoint, you need to stake BST in the governance pool. When you do this, you are effectively buying sBST which entitles you to receive a share of the revenues from the DAO, be that in the form of protocol reward distributions or a share of DAO owned real estate asset revenues.

This leads on nicely to our second use case. When the DAO receives it's revenue share from owned assets, these are paid in DAI. This DAI is then used to buy BST on the open market before the purchased BST is distributed amongst sBST owners in the governance pool.

And the third utility is to secure discounts on Blocksquares platform offering. By purchasing and staking BST, those individuals or organisations looking to run their own marketplace can secure some hefty discounts randing from 10% for 10,000 sBST all the way up to a 100% discount for 100,000 sBST. This also gives customers a corresponding partner status giving a range of benefits such as marketing support, increased Oceanpoint thresholds and so on. Not to mention a share of DAO rewards too.

How to find out more?

I may be biased, but I'd highly recommend this epside of Cryptovium covers for an overview of the Blocksquare project or read my written overview if longform is more your style.

Socials

©2022 cryptovium

cryptovium

cryptovium