Cryptovium covers Blocksquare

Last updated: 18 Jul 2022

What is Blocksquare?

Blocksquare are a project that has been focussing on building both the infrastructure and legal frameworks required for the tokenization of real estate since its ICO back in 2018.

This ICO was intended to be the first of many and only five million of Blocksquare's native token, BST, were minted. As we all know, market conditions deterioated rapidly in 2018 and Blocksquare had to change their plans.

Unlike many other projects that ICOd at this time though, they survived crypto winter and have continued to work on their product and vision.

This involves leveraging the power of blockchain and decentralization, the very heart of Web3, to disrupt the real estate industry by offering an end to end soltion for real estate tokenization.

This includes:

- a tokenization protocol that allows any property to be digitized either fully or partially.

- a white label platform to allow businesses to launcht their own full service, real estate investment platform

- and, with the Oceanpoint DAO, they are looking to increase liquidity in the market and create the worlds first decentralized real estate fund, but more on that later.

Why tokenize real estate?

Tokenization adds a new slice to the tradtional capital stack, one that has the potential to change how we invest in real estate.

Traditionally, real estate is a very illiquid market with property transactions happening relatively infrequently. In fact, despite it being the biggest asset class in the world, it is also one of the most illiquid investments you can make.

Typically investors only engage in the top markets, leaving hundreds of smaller markets suffering from a lack of liquidity. Through tokenization, assets in these smaller markets can be exposed to the global digital economy and add much needed liquidity by attracting a larger number of potential investors.

How tokenization works

The capital stack for a given property is usually made up of two major parts: equity and debt. Tokenizing the debt or equity portions presents a number of challenges - debt is already serviced very well by traditional means and equity ownership is very much an off-chain process in most jurisdictions around the world meaning that there is very little opportunity for on-chain settlement.

Because of this, blocksquare chose to focus in on one aspect of commercial real estate that can be tokenized: the economic rights.

Most commercial real estate has easy to forecast revenues such as leases, rents and so on, with these revenues having a big impact on the valuation of commercial property as investors are usually targeting a given return on their investment.

So the blocksquare tokenization protocol tokenizes the rights to this revenue in the form of a royalty. As part of the tokenization contract, the issuer is agreeing to pay a percentage of revenue to prop token holders. Note the use of the word revenue here. This is an important distinction and means that investors get a share of revenues and NOT profits. This is a much more reliable source of income and much less open to manipulation by the property owner.

These agreements are all codified in an ERC-20 PropToken smart contract and a public coroporate resoltion signed by shareholders of the issuing legal entity and a copy uplodaed and stored on IPFS to give it a fixed online address. This location is defined as a unique hash, with this hash being recorded in the PropToken smart contract.

A tokenized example

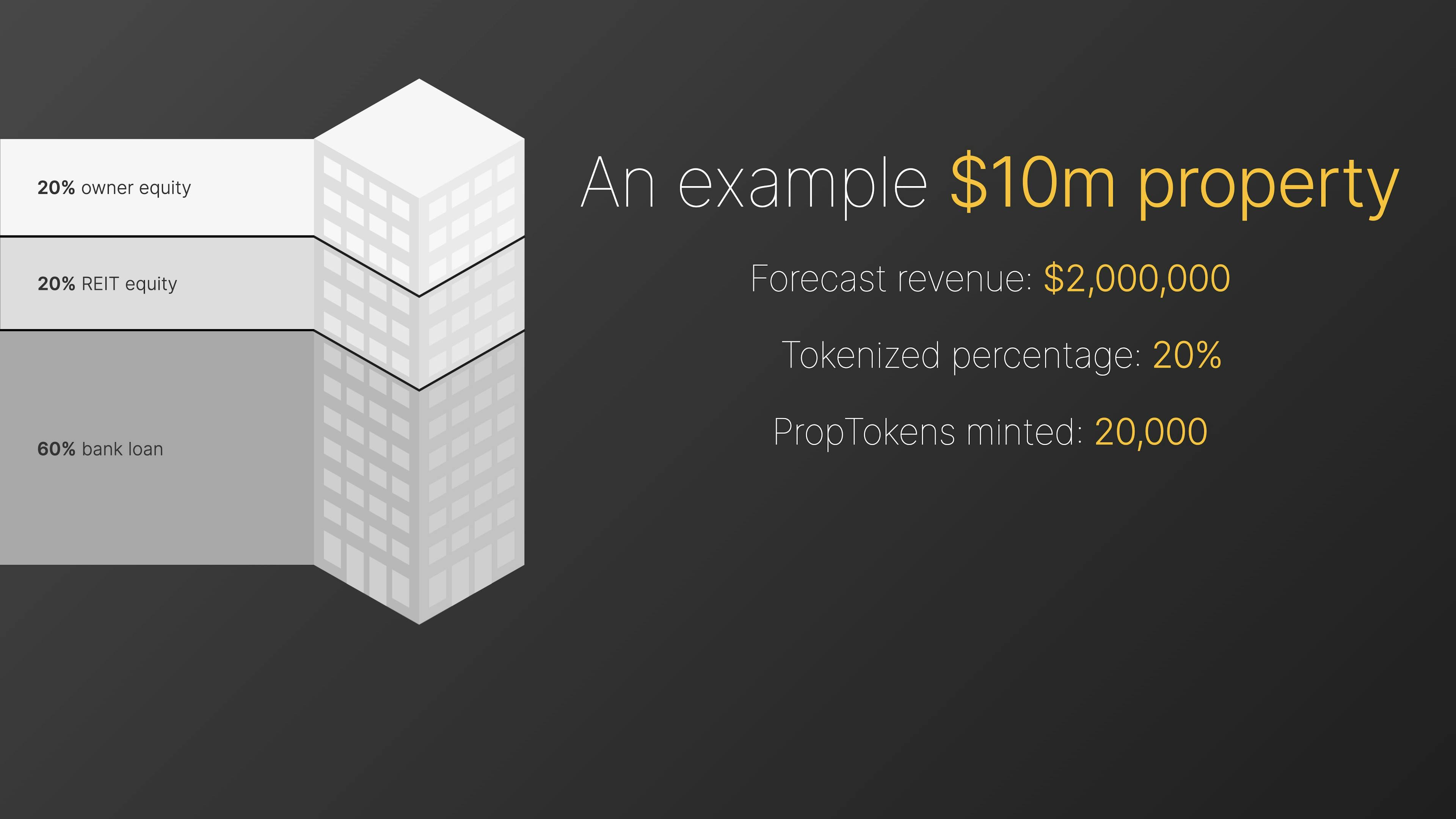

Let's use a property valued at $10m as an example with:

- a 20% owner equity stake

- a 20% equity stake owned by a real estate investment trust

- a bank loan financing the remaining 60%.

If fully occupied, the property is forecast to bring in $2m in revenue. The owners have projected that they will need 40% of this revenue for direct and indirect costs.

In order to decrease their exposure and release funds for other investments, the owners and investment trust have decided to tokenize 20% of the property.

Under the Blocksquare protocol, the entire property is split into 100,000 tokens so, to tokenize 20% of the property, 20,000 tokens are minted from the PropToken contract

Revenues from the property will then be distributed to PropTokens following the formula:

Replacing that with the projected revenue of $2m, the revenue share of 60% and the 20% tokenization value, we get an annual revenue of $240,000 that will be distributed to PropToken holders.

A white label marketplace

In addition to the underlying tokenization protocol, Blocksquare have created a white label platform that allows real estate businesses or startups to launch a real estate investment portal in a matter of weeks with no coding.

This allows businesses to start offering tokenization services to their clients incredibly quickly. The platform handles investor onboarding including automated KYC , the property tokenization process, revenue distribution to token holders, the buying and selling of prop tokens in the form of a secondary market as well as the important aspect of token buyback.

This is usually required when the property is being sold to a third party buyer and the platform gives owners the abiluty to market and pre-negotiate their offer to holders and manage the entire buyback process.

Oceanpoint

The other aspect to the Blocksquare platform is Oceanpoint: a set of smart contracts on Ethereum that form an open ended DAO.

v0.1 of Oceanpoint was launched at the end of February 2022 and gave BST token holders the ability to stake their BST in the new governance pool in return for the DAO governance token: sBST.

Staking in the governance pool launched with a heavily incentivised, single sided staking program for BST where 1m BST tokens a month were distributed amongst stakers for the first three months. This led to some eye watering returns for early investors in the region of 320% APY.

This heavily incentivised staking period has now ended and the monthly distribution has dropped to 500,000 BST tokens, with APYs dropping to a, err, measily 80% APY - still an amazing return and a great opportunity for those who get in early to build a big bag.

This won't last forever though. As things stand today, the full monthly distribution is still being distributed to BST stakers in the governance pool, however v0.2 of Oceanpoint (whose release is due imminently) will see the launch of Oceanpoint's first asset pool which will allow property owners to stake their PropTokens.

After launch, the monthly distribution will be split between the goverance and asset pools to incentivise early property stakers with additional BST rewards.

So why would a property owner want to stake their property?

There is a six month lockup period for those staking their PropTokens, during that time they will receive a share of the BST rewards distributed to asset pool stakers but they will retain full ownership of their tokens and the economic rights that they represent. After the lockup period ends, stakers are faced with a decision: to withdraw their PropTokens or to sell them to the DAO.

This is where things get exciting and where the true potential of Oceanpoint starts to be shown.

If a property owner decides to sell their PropTokens to the DAO and the purchase is approved by the DAO's community, the property owner will be paid the value of the prop tokens in POINT, a new stablecoin pegged to the US dollar and collaterized by the real estate assets held by the DAO.

Once sold, all revenues from the PropTokens will be used to buy BST on the open market and the rewards distributed to DAO participants.

This should have a two fold effect: 1 it should drive up the market price of BST and 2 it should increase the amount of rewards paid to DAO participants.

The world's first decentralized real estate fund

At this stage, Oceanpoint effectively becomes the world's first truly decentralized real estate fund. One that has been designed from the ground up to hold an unlimited amount of real estate assets and be open to anyone to invest in, no matter how much they have to invest or where in the world they are. This is when real estate truly meets DeFi.

Except… it's unlike any other real estate fund out there. This is partly down to the fact that it doesn't own equity in any property, instead it owns tokenized economic rights that property owners commit to pay to the DAO, it also doesn't have any shareholders, instead it is governed by the community, and it also doesn't pool funds, it has POINT.

In this way, Oceanpoint acts more like a real estate backed central bank than fund. Oceanpoint mints POINT when a PropToken is bought by the DAO, and burns it when a PropToken is sold. In this way, POINT and the TVL of Oceanpoint are intrinsicaly tied and ensures that POINT is collaterised appropriately.

Oceanpoint's roadmap

As previously mentioined, v0.1 of Oceanpoint launched in February of 2022. This brought with it BST staking, with all rewards being distributed to the governance pool

At the time of recording, v0.2 is in the final stages of its audit and is expected to launch any day now. This brings Oceanpoints first Asset pool and will trigger a change in the reward ditribution with monthly rewards being split between the governance and asset pools.

With v0.3, Oceanpoint are adding BST liquidity pools, most likely BST:ETH on Uniswap. This will see half of the monthly rewards being distributed to the LPs, with the other half being split between the governance and asset pools.

And finally we have v0.4 which will introduce POINT liquidity pools. This wil see another change in reward distributuon, however the figures shown on screen are not finalised and, in fact, will be set by the community through a voting mechanism. This will mark the start of the DAO becoming more autonomous and self-governing.

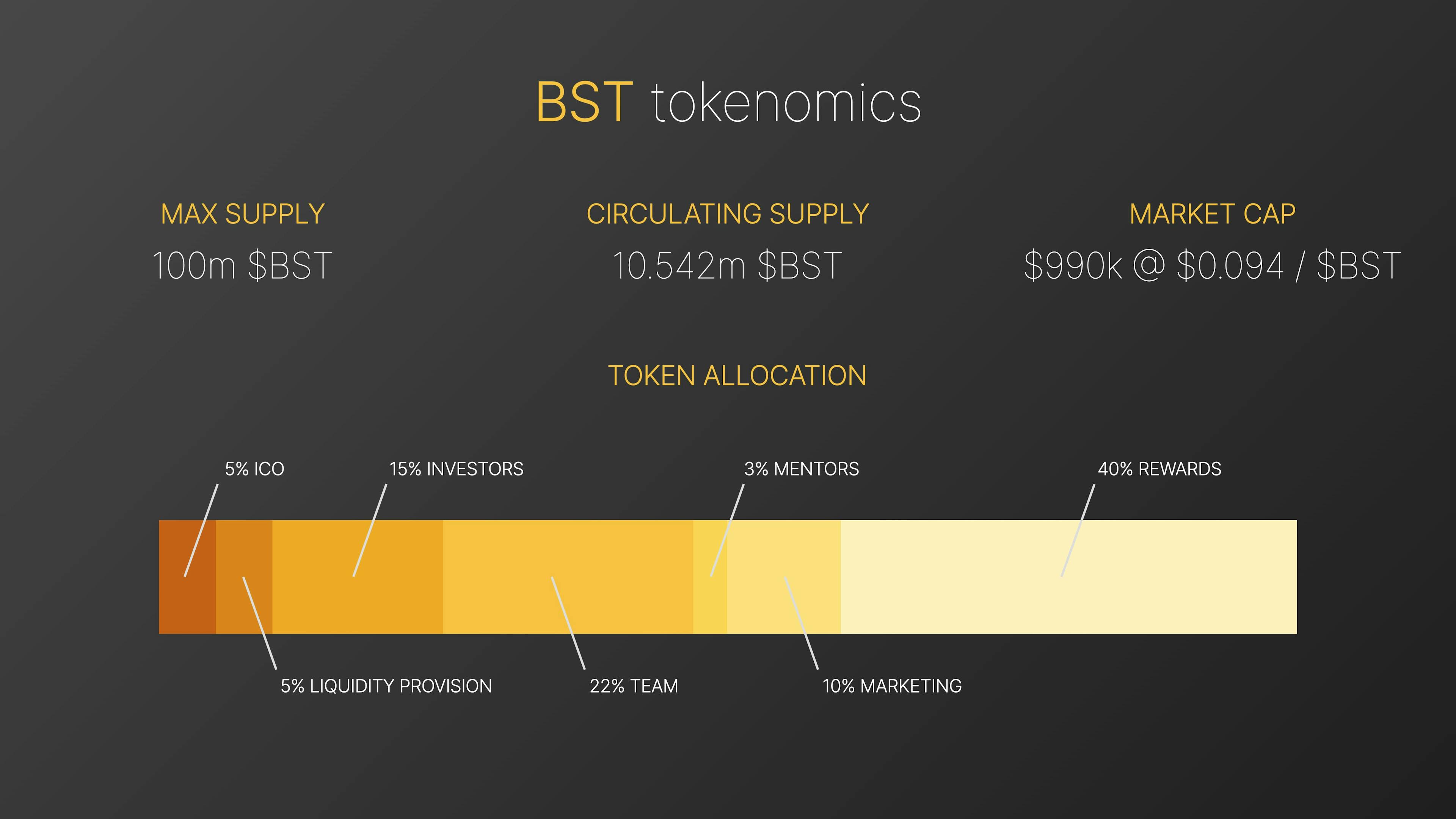

BST tokenomics

One aspect of BST that we haven't covered yet is it's tokenomics. I'm sure some watchers will have raised their eyebrows at the sizable monthly reward distributions and be wondering where this all comes from and how sustainable it is.

So let's dig a little deeper.

The max supply of BST is 100m tokens. 5m of these tokens were sold during the 2018 ICO to investors (of which I was one) with a further 5.142m tokens having been minted since v0.1 launch in February (through a combination of rewards and liquidity provision on Ethereum.

That leaves us with a current circulating supply of 10.542m BST.

Giving a market cap of about $1m at the time of writing. Yes, you read that correctly, one million dollars. In my opinion and, of course, this is just my opinion and not financial advice, Blocksquare is one of those hidden gems that has potential to explode in price as they deliver on their roadmap and start to increase the TVL of real estate on the protocol. At 100x we're only looking at a $100m valuation and… I think we can go a lot higher than that if things continue to develop in the way they're developing.

So enough about the current sitution, let's look at how the total supply is going to be allocated:

- 5m tokens or 5% of total supply were sold as part of the initial ICO

- a further 5% being allocated for liquidity provision.

- other investors hold 15% of tokens

- the team hold 22% of tokens with these vesting two years after the launch of Oceanpoint on the 22nd of February, 2024.

- mentors hold 3% of tokens, with their tokens vesting 12 months after the launch of Oceanpoint on 22nd February, 2023.

- 10% of tokens have been set aside for marketing activities, a sum that to date has hardly been touched and is being held in reserve for later this year after Oceanpoint is more fully developed.

- and the final 40% of the total supply will be used for rewards provision to the various pools. For the first three months this equated to 1m tokens a month, leaving a further 74 months (or 6 years) of incentivised reward distribution before Oceanpoint transitions to a self rewarding model from onboarded asset revenues.

BST utility

There are three main uses for BST.

First and foremost, BST acts as the Governance token for Oceanpoint. In order to be involved in DAO votes and help shape the future of Oceanpoint, you need to stake BST in the governance pool. When you do this, you are effectively buying sBST which entitles you to receive a share of the revenues from the DAO, be that in the form of protocol reward distributions or a share of DAO owned real estate asset revenues.

This leads on nicely to our second use case. When the DAO receives it's revenue share from owned assets, these are paid in DAI. This DAI is then used to buy BST on the open market before the purchased BST is distributed amongst sBST owners in the governance pool.

And the third utility is to secure discounts on Blocksquares platform offering. By purchasing and staking BST, those individuals or organisations looking to run their own marketplace can secure some hefty discounts randing from 10% for 10,000 sBST all the way up to a 100% discount for 100,000 sBST. This also gives customers a corresponding partner status giving a range of benefits such as marketing support, increased Oceanpoint thresholds and so on. Not to mention a share of DAO rewards too.

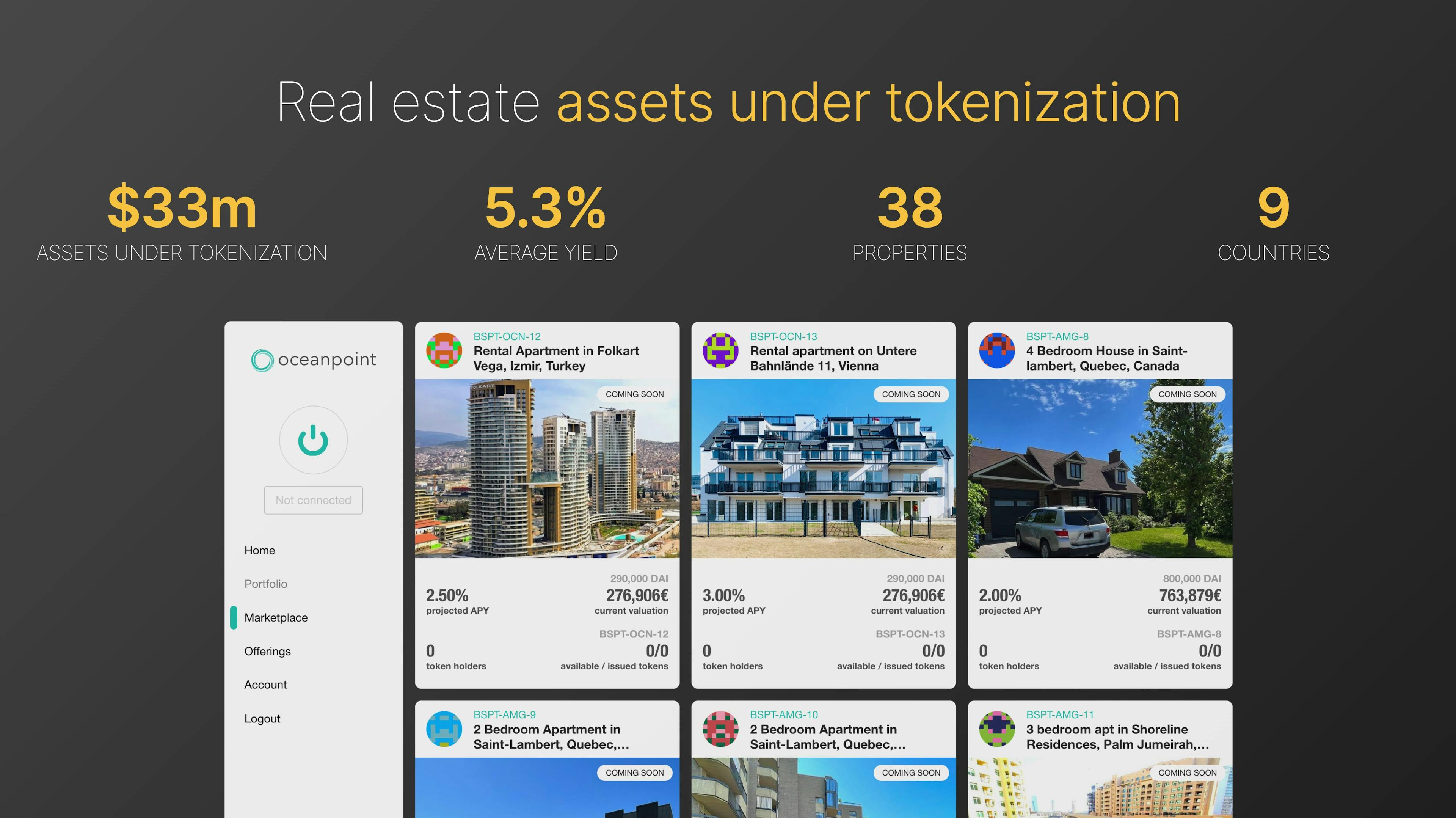

Real estate assets under tokenization

One other area that we should look at is the total value of real estate assets under tokenization. This gives some indication to the potential for TVL after the launch of v0.2 of Ocenapoint in coming months.

So at the time of recording, there was a total of $33m dollars in total assets under tokenization

These assets are returning a projected average yield of 5.3% across a total of 38 properties in 9 countries around the world.

All of these properties are viewable in the Oceanpoint marketplace, which you can keep an eye on for any new properties being added. Properties are being tokenized at a steady pace with a few new ones being added on average every week. The growth in tokenized properties is really quite impressive and shows the potential for Oceanpoint, Blocksquare and the future valuation of BST.

Exchanges

BST isn't on any CEX's yet, but can be bought on one of the Etereum DEXs like Uniswap or 1inch.

Socials

©2022 cryptovium

cryptovium

cryptovium