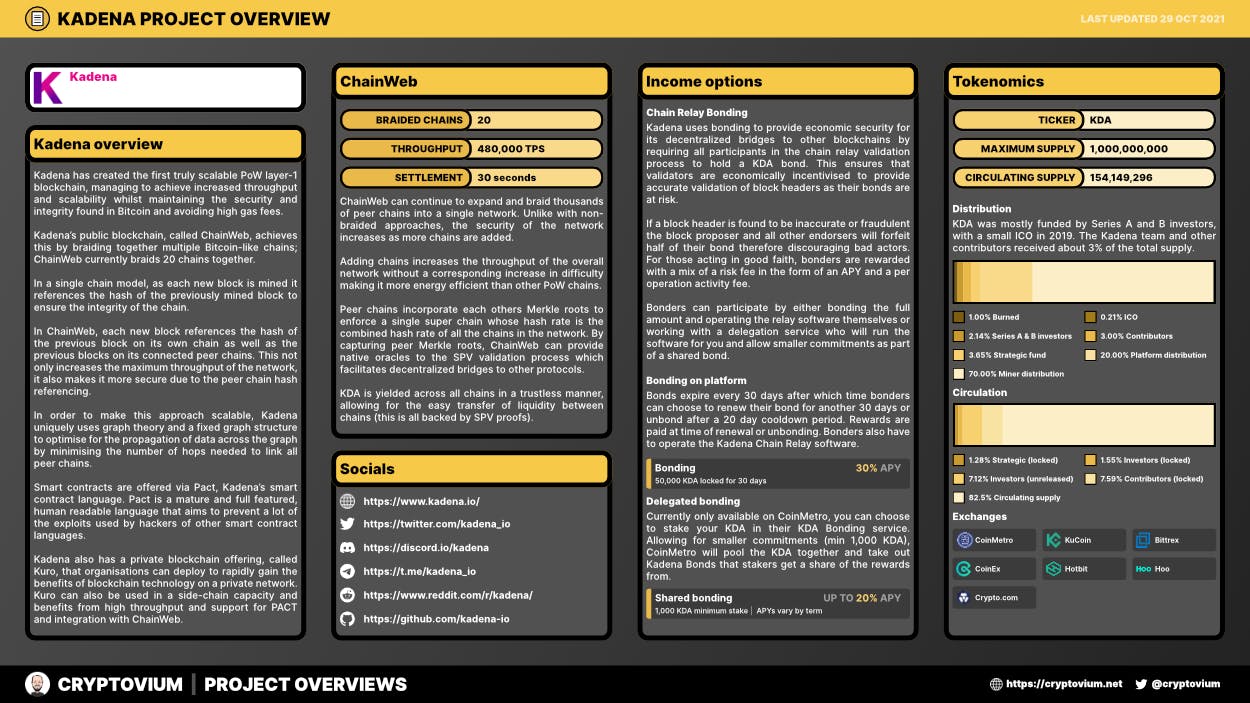

Kadena project overview

Last updated: 7 Sep 2021

Kadena overview

Kadena has created the first truly scalable PoW layer-1 blockchain, managing to achieve increased throughput and scalability whilst maintaining the security and integrity found in Bitcoin and avoiding high gas fees.

Kadena’s public blockchain, called ChainWeb, achieves this by braiding together multiple Bitcoin-like chains; ChainWeb currently braids 20 chains together.

In a single chain model, as each new block is mined it references the hash of the previously mined block to ensure the integrity of the chain.

In ChainWeb, each new block references the hash of the previous block on its own chain as well as the previous blocks on its connected peer chains. This not only increases the maximum throughput of the network, it also makes it more secure due to the peer chain hash referencing.

In order to make this approach scalable, Kadena uniquely uses graph theory and a fixed graph structure to optimise for the propagation of data across the graph by minimising the number of hops needed to link all peer chains.

Smart contracts are offered via Pact, Kadena’s smart contract language. Pact is a mature and full featured, human readable language that aims to prevent a lot of the exploits used by hackers of other smart contract languages.

Kadena also has a private blockchain offering, called Kuro, that organisations can deploy to rapidly gain the benefits of blockchain technology on a private network. Kuro can also be used in a side-chain capacity and benefits from high throughput and support for PACT and integration with ChainWeb.

ChainWeb

ChainWeb can continue to expand and braid thousands of peer chains into a single network. Unlike with non-braided approaches, the security of the network increases as more chains are added.

Adding chains increases the throughput of the overall network without a corresponding increase in difficulty making it more energy efficient than other PoW chains.

Peer chains incorporate each others Merkle roots to enforce a single super chain whose hash rate is the combined hash rate of all the chains in the network. By capturing peer Merkle roots, ChainWeb can provide native oracles to the SPV validation process which facilitates decentralized bridges to other protocols.

KDA is yielded across all chains in a trustless manner, allowing for the easy transfer of liquidity between chains (this is all backed by SPV proofs).

Income options

Chain Relay Bonding

Kadena uses bonding to provide economic security for its decentralized bridges to other blockchains by requiring all participants in the chain relay validation process to hold a KDA bond. This ensures that validators are economically incentivised to provide accurate validation of block headers as their bonds are at risk.

If a block header is found to be inaccurate or fraudulent the block proposer and all other endorsers will forfeit half of their bond therefore discouraging bad actors. For those acting in good faith, bonders are rewarded with a mix of a risk fee in the form of an APY and a per operation activity fee.

Bonders can participate by either bonding the full amount and operating the relay software themselves or working with a delegation service who will run the software for you and allow smaller commitments as part of a shared bond.

Bonding on platform

Bonds expire every 30 days after which time bonders can choose to renew their bond for another 30 days or unbond after a 20 day cooldown period. Rewards are paid at time of renewal or unbonding. Bonders also have to operate the Kadena Chain Relay software.

Delegated bonding

Currently only available on CoinMetro, you can choose to stake your KDA in their KDA Bonding service. Allowing for smaller commitments (min 1,000 KDA), CoinMetro will pool the KDA together and take out Kadena Bonds that stakers get a share of the rewards from.

Tokenomics

Distribution

KDA was mostly funded by Series A and B investors, with a small ICO in 2019. The Kadena team and other contributors received about 3% of the total supply.

Circulating supply

The circulating supply of KDA is distributed as follows:

Exchanges

You can buy KDA on these exchanges:

- Coinmetro: KDA/USD | KDA/EUR

- Kucoin: KDA/USDT | KDA/BTC

- Bittrex: KDA/USDT | KDA/BTC

- CoinEx: KDA/USDT | KDA/BTC

- Hotbit: KDA/USDT | KDA/BTC

- Hoo: KDA/USDT

Socials

©2022 cryptovium

cryptovium

cryptovium