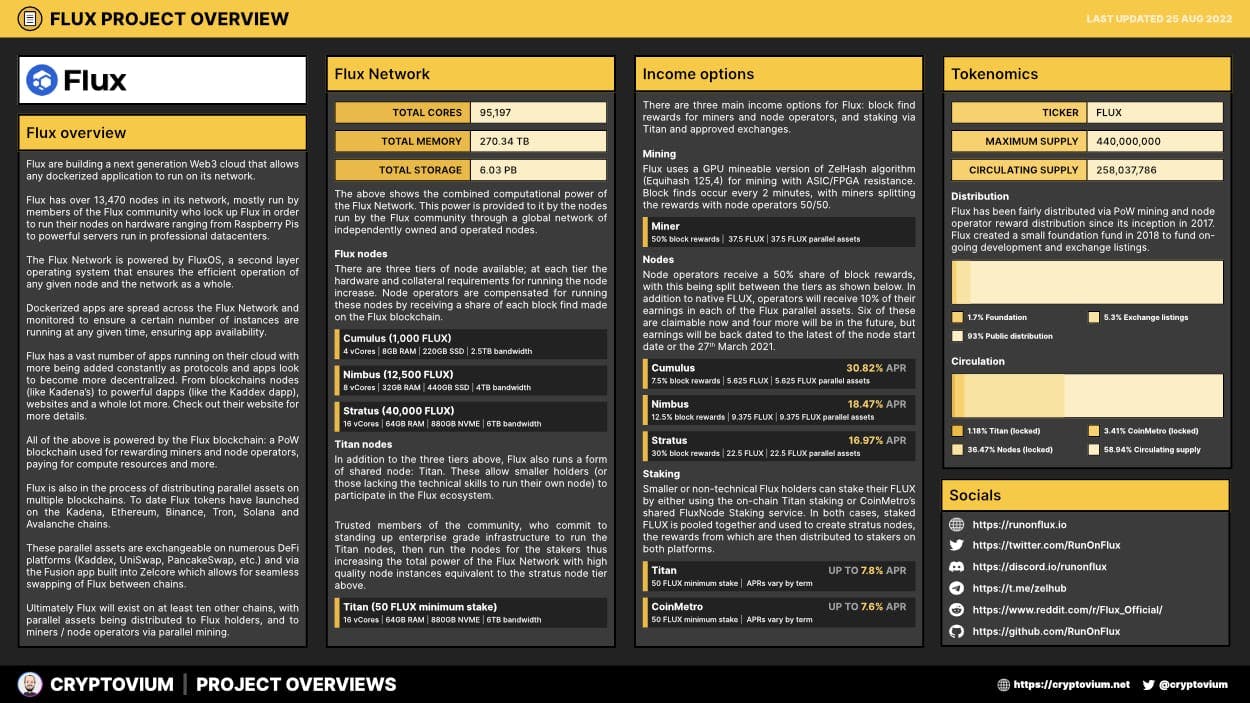

Flux project overview

Last updated: 18 Jul 2022

Flux overview

Flux are building a next generation Web3 cloud that allows any dockerized application to run on its network.

Flux has over 13,470 nodes in its network, mostly run by members of the Flux community who lock up Flux in order to run their nodes on hardware ranging from Raspberry Pis to powerful servers run in professional datacenters.

The Flux Network is powered by FluxOS, a second layer operating system that ensures the efficient operation of any given node and the network as a whole.

Dockerized apps are spread across the Flux Network and monitored to ensure a certain number of instances are running at any given time, ensuring app availability.

Flux has a vast number of apps running on their cloud with more being added constantly as protocols and apps look to become more decentralized. From blockchains nodes (like Kadena’s) to powerful dapps (like the Kaddex dapp), websites and a whole lot more. Check out their website for more details.

All of the above is powered by the Flux blockchain: a PoW blockchain used for rewarding miners and node operators, paying for compute resources and more.

Flux is also in the process of distributing parallel assets on multiple blockchains. To date Flux tokens have launched on the Kadena, Ethereum, Binance, Tron, Solana and Avalanche chains.

These parallel assets are exchangeable on numerous DeFi platforms (Kaddex, UniSwap, PancakeSwap, etc.) and via the Fusion app built into Zelcore which allows for seamless swapping of Flux between chains.

Ultimately Flux will exist on at least ten other chains, with parallel assets being distributed to Flux holders, and to miners / node operators via parallel mining.

Flux Network

The above shows the combined computational power of the Flux Network. This power is provided to it by the nodes run by the Flux community through a global network of independently owned and operated nodes.

Flux nodes

There are three tiers of node available; at each tier the hardware and collateral requirements for running the node increase. Node operators are compensated for running these nodes by receiving a share of each block find made on the Flux blockchain.

Titan nodes

In addition to the three tiers above, Flux also runs a form of shared node: Titan. These allow smaller holders (or those lacking the technical skills to run their own node) to participate in the Flux ecosystem.

Trusted members of the community, who commit to standing up enterprise grade infrastructure to run the Titan nodes, then run the nodes for the stakers thus increasing the total power of the Flux Network with high quality node instances equivalent to the stratus node tier above.

Income options

There are three main income options for Flux: block find rewards for miners and node operators, and staking via Titan and approved exchanges.

Mining

Flux uses a GPU mineable version of ZelHash algorithm (Equihash 125,4) for mining with ASIC/FPGA resistance. Block finds occur every 2 minutes, with miners splitting the rewards with node operators 50/50.

Nodes

Node operators receive a 50% share of block rewards, with this being split between the tiers as shown below. In addition to native FLUX, operators will receive 10% of their earnings in each of the Flux parallel assets. Six of these are claimable now and four more will be in the future, but earnings will be back dated to the latest of the node start date or the 27th March 2021.

Staking

Smaller or non-technical Flux holders can stake their FLUX by either using the on-chain Titan staking or CoinMetro’s shared FluxNode Staking service. In both cases, staked FLUX is pooled together and used to create stratus nodes, the rewards from which are then distributed to stakers on both platforms.

Tokenomics

Distribution

Flux has been fairly distributed via PoW mining and node operator reward distribution since its inception in 2017. Flux created a small foundation fund in 2018 to fund on-going development and exchange listings.

Circulating supply

The circulating supply of FLUX is distributed as follows:

Exchanges

You can buy FLUX on these exchanges:

- Coinmetro: FLUX/USD | FLUX/EUR

- Binance: FLUX/USDT

- Kucoin: FLUX/USDT

- Bittrex: FLUX/USDT

- CoinEx: FLUX/USDT | FLUX/BTC

- Hotbit: FLUX/USDT | FLUX/ETH | FLUX/BTC

- Gate.io: FLUX/USDT | FLUX/ETH

- PancakeSwap: FLUX pools

- UniSwap: FLUX/USDT

- 1inch: FLUX pools

- Kaddex: FLUX/KDA

- Citex: FLUX/BTC

- STEX: FLUX/ETH | FLUX/BTC

- Bitrue: FLUX/USDT

- SafeTrade: FLUX/BTC

- TradeOgre: FLUX/BTC

Socials

©2022 cryptovium

cryptovium

cryptovium